R&D Tax Incentive

What is the Research and Development (R&D) Tax Incentive?

The R&D Tax Incentive Program is implemented and designed by the Australian government through the Australian Taxation Office (ATO) and AusIndustry to support businesses to participate in the Australian Innovation Economy.

This program encourages businesses to undertake research and development activities and projects to improve their products and services that will serve to benefit their clients and consumers to grow through both local and international markets.

The R&D Tax Incentive can be referred to as either the R&D tax offset, R&D tax rebate, or R&D tax credit – they are all one in the same.

What are the benefits of the R&D Tax Incentive?

Depending on your aggregated turnover and final tax position, the program provides businesses with either a refund or a tax offset against tax liabilities or a combination of the two:

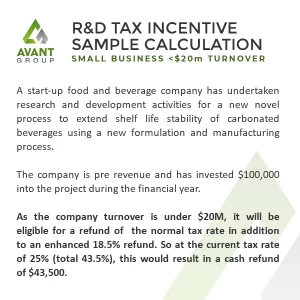

Small Businesses and Startups

Eligible businesses or entities undertaking R&D related activities and projects with an annual total aggregated turnover of less than $20 million, that are not controlled by any entities that are exempt from income tax, are eligible for a refundable tax offset which is calculated as the company tax rate plus 18.5%, currently providing a tax offset/refund between 43.5% and 48.5%.

If the company tax rate changes, the offset rate will change too.

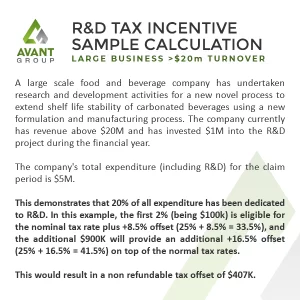

Large Businesses

Other eligible entities with a turnover above $20 million that are undertaking R&D related projects and activities are eligible for a non-refundable tax offset, depending on their R&D intensity levels.

The new threshold measure for non-refundable offset rates is calculated as a percentage of R&D expenditure over total expenditure, (the R&D Intensity).

R&D expenditure below 2% of the total expenditure has an offset rate of +8.5% over the company tax rate. R&D expenditure exceeding 2% has an offset rate of +16.5% over the company tax rate, providing an exceptional position for businesses that are investing heavily into local R&D activities.

To provide an example, if a company’s total expenditure is $15m then the R&D intensity threshold (at 2% of company expenditure) is $300,000.

If the company spends $500,000 on R&D, then the first $300,000 will provide the nominal tax rate plus +8.5% offset, and the additional $200,000 will provide an additional +16.5% offset on top of the normal tax rates.

If the company tax rate is 25% ($20m < Aggregated Turnover < $50m for FY22), then the total R&D offset is:

(300,000*33.5%) + (200,000*41.5%) = $183,500

If the company tax rate is 30% (Aggregated Turnover > $50m) then the total R&D offset is:

(300,000*38.5%) + (200,000*46.5%) = $208,500

Note that tax consolidated groups will have a higher total expenditure than independent entities.

There is also a $150 million cap on notional R&D deductions, therefore any expenditure above this cap only gets the standard company tax rate, not the premium offset.

R&D Activity Exclusions – Gambling & Tobacco

From July 1 2025 (pending legislation), R&D activities related to gambling and tobacco are excluded and no longer eligible R&D activities.

R&D Activity Registration Timeframes

R&D Activities must be registered within a specific timeframe in order to claim the R&D Tax Incentive. This timeline varies depending on when a company’s financial year ends.

For companies with a financial year ending on June 30th, R&D activities must be registered between July 1st and April 30th the following year.

For companies with a financial year ending on December 31st, R&D activities must be registered between January 1st and October 31st the following year.

Example R&D Tax Incentive Calculations:

Small business

Large business

R&D Tax Incentive Eligibility Guidelines:

The research and development project activity that an organisation is undertaking must meet specific criteria to be considered eligible for the program. These activities have to be categorised into either Core or Supporting research activities.

A project must carry both technical and financial risk for an organisation, be undertaken for the purpose of generating new knowledge and have an unknown outcome. A company must also apply a scientific methodology to a project and structure its documents and supporting evidence accordingly.

Research & Development projects that are eligible for government schemes i.e. the R&D Tax Incentive or other government sources of funding, must comply with often complex legislation and good business practice in case of an audit.

If AusIndustry finds your R&D application did not provide enough proof of your registered R&D activities, AusIndustry may seek to recoup or clawback the grant, requiring you to pay back the rebate you have received to date through the scheme plus a fine.

Overseas R&D Activities

You can claim overseas R&D activities as part of an Australian project. However, to do this you must apply for and receive a finding that overseas R&D activities are eligible. You must register these activities.

To receive an Overseas Finding, you must demonstrate the R&D activity meets the following four conditions:

1. Your overseas R&D activity must be an R&D activity

The overseas activity must meet the R&D Tax Incentive program’s requirements for being either a core R&D activity or a supporting R&D activity.

2. There must be a scientific link to an Australian core R&D activity

You need to show that:

- there is a link between your planned overseas activity and your eligible Australian core R&D activity

- you can’t complete the Australian core R&D activity without conducting the overseas activity.

3. The overseas R&D activity must not be able to be conducted in Australia or its external Territories

You must demonstrate why the activity can’t be solely conducted in Australia. There are 4 allowable reasons.

The activity:

- requires facilities, expertise or equipment which are not available in Australia

- would contravene a law relating to quarantine

- requires a population (of living things) which are not available in Australia

- requires access to geographical or geological features that are not available in Australia

Financial reasons alone are insufficient for an overseas activity to meet this condition.

4. The costs of overseas R&D activities must be less than the costs of related R&D activities undertaken solely in Australia

If the anticipated expenditure for your overseas R&D activities is greater than the anticipated expenditure on the related Australian R&D activities we’ll not find them eligible.

You’ll need to include what you reasonably anticipate the expenditure will be in all income years, when you apply for an Overseas Finding.

Still not sure if you qualify? Get in touch with our team for a complimentary assessment of your R&D activities.

How Avant Group can help

Our team can help you get the R&D tax incentive.

When you’re a business owner, you may not have time to work through the red tape and audits required to apply for government grants.

Avant Group is your partner for success. We take all the hassle out of the application process whilst working with your team to assist with reporting and compliance requirements – so you can focus on running your business.

Avant Group offers:

- All AusIndustry auditing management for engaged clients included at no additional cost

- Hands-on technical project management covering application writing and administration aspects

- A highly skilled advisory team with consultants from engineering, marketing and finance disciplines

- A dedicated account manager who will work with you every step of the way with your grant application

Learn more about the R&D Tax Incentive

How to prepare your R&D Tax Incentive claim in preparation for the end of financial year |

How to register Avant Group as your agent for the R&D Tax Incentive AusIndustry portal |